Shipping companies pay for CO₂ emissions for the first time

Dutch and internationally operating shipping companies under Dutch jurisdiction were recently required to report their CO₂ emissions for the year 2024 through an emissions report. Based on this data, they must submit emission allowances for the first time under the European Emissions Trading System (EU ETS) by the end of September 2025 at the latest.

This obligation encourages the maritime sector to invest in cleaner technologies and alternative fuels, with the goal of reducing the use of fossil energy sources and the associated CO₂ emissions.

Compliance

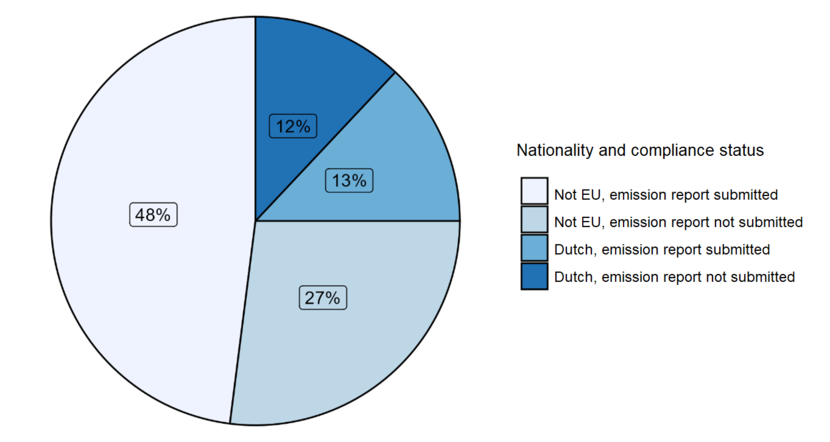

Of the 378 shipping companies assigned to the Netherlands by the European Commission, approximately 60% have met the reporting requirements. These companies submitted a verified emissions report to the Dutch Emissions Authority (NEa) by the March 31 deadline. Together, the 378 companies represent over 1,400 vessels, with about 25% of the companies registered in the Netherlands and 75% outside the EU (see the figure below for compliance figures and company nationality breakdown).

Since the deadline, an additional 14% of companies have submitted an emissions report. As of April 17, this brings the total compliance rate to 74%. A large portion of the outstanding reports is still in the pipeline. Companies that have not yet submitted their report have either already been contacted or will soon be approached by the NEa to do so.

Outlook

In the coming months, the NEa will focus on collecting the remaining emissions reports. This autumn (by September 30, 2025 at the latest), shipping companies—including those that have not yet submitted a report—must surrender their emission allowances to the NEa for the first time. If a company fails to meet this obligation, the NEa will impose a fine.

The European Commission has introduced a phase-in period for these ETS obligations: for the year 2024, shipping companies only need to surrender allowances for 40% of their CO₂ emissions. This percentage increases to 70% in 2025, and from 2026 onwards, companies must compensate for 100% of their CO₂ emissions with purchased allowances. Additionally, from 2026, allowances must also be surrendered for two other greenhouse gases: methane (CH₄) and nitrous oxide (N₂O).

Context: Emissions Trading System in the Maritime Sector

The European Emissions Trading System (EU ETS) is a market-based instrument aimed at reducing greenhouse gas emissions in a cost-effective way, helping the European Union achieve its climate goals. Emission trading involves the trade of allowances giving right to emit a certain quantity of greenhouse gases. As buyers and sellers trade these allowances, greenhouse gas emissions acquire a price. Companies must purchase sufficient allowances annually to cover their emissions.

In December 2022, a European agreement was reached to extend the existing EU ETS to the maritime sector. As a result, large vessels (over 5,000 gross tonnage) calling at EU ports have been subject to the ETS since January 1, 2024, and were required to submit their emissions reports by March 31, 2025. The aim of the measure is identical to that for other sectors: the ETS gives companies—in this case, shipping companies—a choice: pay for the right to emit CO₂ or reduce emissions by investing in cleaner shipping technologies.

The maritime sector is crucial to achieving the goals of the Paris Agreement, as it contributes significantly to total emissions in Europe. In 2021, the sector emitted more than 124 million tons of CO₂ (see the European Commission website), accounting for between 3% and 4% of the European total.

Companies already participating in the ETS—such as those in the industrial, energy, and aviation sectors—were also required to submit their emissions reports by March 31. Almost all companies (around 99%) in these sectors succeeded in doing so on time. It is worth noting that these sectors have been subject to these obligations for a longer time, which likely explains their higher compliance rate.